Conversational AI: 4 Use Cases In Banking

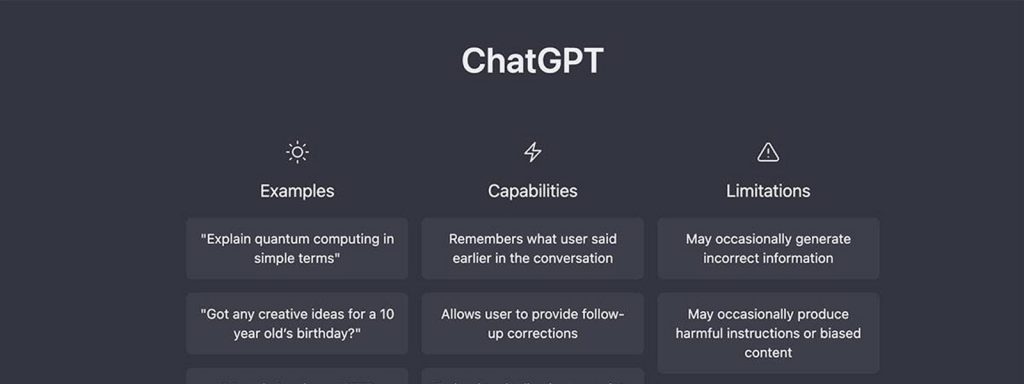

As the world loses it’s head over ChatGPT, now is the time to re-open the discussion around how the banking sector can optimise processes and provide better customer service using conversation AI.

This blog article looks at four use cases for conversational AI chatbots in banking and how they can benefit firms of all sizes. From streamlining customer service to personalising the customer experience, we will explore the different ways conversational AI or intelligent virtual assistants (IVA) can be used to improve the bank-customer relationship.

The importance of conversational AI in the banking industry

The banking and financial services industry is rapidly evolving, and one of the drivers of this change is conversational AI. With conversational AI, banks can automate mundane tasks such as answering customer inquiries to make it easier and faster to provide customer service.

Additionally, conversational AI can help banks identify trends in customer behaviour and provide personalised recommendations based on individual customer needs. This can help banks to better understand their customers and provide more tailored services. Research from Verint shows companies achieved a 12% increase in revenue with an IVA augmenting chat which suggests the improved customer experience through AI can help banks to increase their customer satisfaction and loyalty.

As more people become familiar with tools like ChatGPT, conversational AI is only going to become an important tool for the banking industry, helping them to stay competitive in an ever-changing landscape.

AI Chatbots in banking: the obvious use cases

Here are four potential use cases that demonstrate the possibilities with banking chatbots:

-

Streamlining customer service

-

Personalising customer experience

-

Generating leads

-

Improving collections

1. Streamlining customer service

One of the most obvious ways conversational AI chatbots can be used in banking is to streamline customer service. By automating simple tasks and freeing up customer service representatives to handle more complex inquiries, chatbots can help banks improve their efficiency and improve the quality of service they provide to their customers.

Customers can use a chatbot or intelligent service to solve simple, frequently asked queries such as ‘How to create a new savings account’, or ‘what should I do if my card is lost or stolen’. Bots can quickly direct users to the correct page on the website or for more technical queries. They can gather adequate information to then direct the user to the correct department. This saves time for both the customer and the branch staff.

2. Personalising customer experience

Another way conversational AI can be used in banking is to personalise the customer experience. By collecting data about customer preferences and integrating your chatbot to this database, you can tailor the interaction to the individual and provide a more personalised experience that is likely to result in a satisfied customer.

An example of this would be when a customer is having a conversation with a chatbot, the system will have all the data about the customer, including their name, account details, what pages they visited last, what page they launched the chat from, and even their preferred language.

One of the most frustrating parts of the customer service journey is having to repeat information or going around in cycles with no clear way of reaching a human. By incorporating this data, you can shorten customer journeys and make the process smooth and efficient.

For example, if a customer launches a chat on the fraud page, you can quickly connect them straight to the relevant department without sending them through the entire customer service pathway. Likewise for new accounts, investments, local enquiries, etc.

3. Generating leads

Conversational AI chatbots can also be used to generate leads for banks. By engaging in conversations with potential customers, chatbots can identify needs and offer personalised solutions that may result in a new customer for the bank.

For example, a customer could be inquiring about opening a new account and based on the data given, such as their age, chatbots can suggest a student account as the more suitable and attractive option for the user.

4. Banking on the go

Convenience is everything. Customers want to be able to access their banking services quickly and easily without sacrificing security or comfort.

This is where virtual banking assistants come in. Virtual banking assistants allow customers to do everything from sending money to checking account balances and setting up recurring payments. But they have the benefit of not requiring a user to speak or receive personal information out loud.

When you’re out in public it is often incredibly uncomfortable to disclose to others what your problem is. Imagine having to announce on a busy bus why your account has become overdrawn. A conversation AI tool provides that privacy while maintaining security and convenience.

By providing users with the tools they need to protect their data, they can make informed decisions about how to communicate securely. Giving users the ability to choose how best to protect their data is essential in today’s digital world, and it’s important to ensure that these options are available at all times.

Improving On The Current Experiences

The use of conversational AI Chatbots in isolation is a problem. It’s what creates those frustrating experiences that give the technology a bad name.

Chatbots in isolation do not provide great user experiences, as they tend to be limited in what they can do, which can lead to frustration as users are forced to repeat themselves.

To improve their effectiveness, chatbots should always be linked to other self-service tools and databases to provide a seamless experience. This way, chatbots can access information from other sources and provide accurate, up-to-date information to users.

For example, if a customer is asking about a product, the chatbot could access a database of product information and provide detailed information about the product within seconds. Additionally, chatbots can be linked to other self-service tools, such as FAQs and knowledge bases, so that users can easily find the answers they are looking for. By linking chatbots to other self-service tools and databases, banks can ensure that their customers have a positive experience and are able to find the information they need quickly and easily.

On a final note…

The use of conversational AI chatbots in the banking industry has been a rapidly growing trend in recent years. With the current surge in interest, AI chatbots can offer an easy and convenient way for customers to interact with their bank, as they are available 24/7 and can quickly provide answers to customer queries.

Younger customers in particular are flocking to banks like Monzo and Starling because of their readiness to give customers what slow moving incumbent banks can’t.

While AI chatbots are still in the early stages of development, they are proving to be a promising tool for banks to make their customer service more efficient and effective. For customers, this means that banking services will become more convenient and accessible than ever before.